A silver lining to the rout in the financial markets in 2022 is that cash and cash-equivalents are actually paying decent interest. As I write this, FDIC insured high-yield savings accounts are paying 3.3%, one-year CDs are paying 4.5%, and one-year Treasuries are paying 4.7%.

With such attractive risk-free yields, why would I even consider investing in anything that comes with risk of loss? It’s a fair question. It’s been over 15 years since we’ve seen savings accounts pay anywhere near this well, so shouldn’t we take advantage of the times and park our money in these vehicles?

The answer becomes obvious when you consider inflation – or the rising cost of goods and services. The goal over one’s lifetime is to increase purchasing power over time. This means your investments should grow at a quicker rate than the cost of goods. If your investments don’t outpace inflation, you will actually feel poorer as time goes on because your dollars won’t buy as much as they used to (anyone remember gas being $0.25/gallon?! Me neither, but it used to be).

It’s easy to see if you look around right now. According to the Wall Street Journal, today’s inflation reading came in at 6.5%, down from a peak of 9.1% in June of 20221. So, if you’re earning 4% on your savings account, but inflation is 6.5%, you’re actually losing purchasing power. You won’t feel a difference in your monthly budget immediately, but over time you’ll certainly feel that pinch.

Almost by definition, cash doesn’t keep pace with inflation. That is why we’re seeing 4% cash yields while inflation is 6.5%. Two years ago (coming out of the peak of COVID), high-yield savings accounts were paying 0.5% and inflation was 1.23%2. Notice a trend?

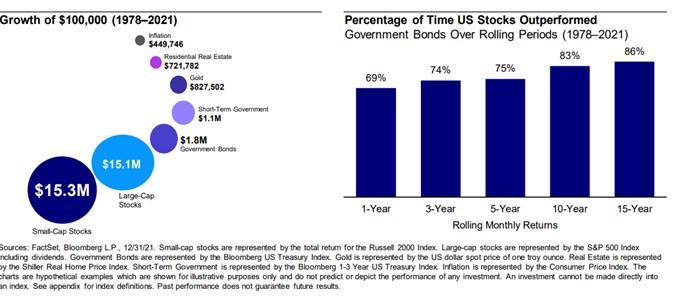

So, if the goal is to increase purchasing power over time, how do we do that? By taking risk, that’s how. The below chart shows how various asset classes have performed over the last 30 years.

$100k in 1978 is now worth $450k after accounting for inflation. $100k invested in the S&P 500 in 1978 is now worth $15.1 million. Now consider that in 2022 the S&P 500 was down 18% and the 10-year Treasury bond was down 16%. It sure sounds like prices are sale right now, even if we haven’t found a bottom yet.

For money that isn’t earmarked for use over the next year or two, consider me a strong buyer of stocks and bonds, even though savings rates are paying 4% right now.

1 https://www.wsj.com/articles/us-inflation-december-2022-consumer-price-index-11673485441

These are the opinions of Legacy Wealth Management, LLC and not necessarily those of Cambridge, are for informational purposes only, and should not be construed or acted upon as individualized investment advice. Dan Funderburk is a Registered Representative offering securities through Cambridge Investment Research, Inc., a Broker/Dealer, Member FINRA/SIPC. Investment Advisor Representative, Cambridge Investment Research Advisors, Inc., a Registered Investment Advisor. Legacy Wealth Management, LLC and Cambridge are not affiliated. Cambridge does not offer tax advice. Copyright ©2023 Dan Funderburk. All Rights reserved. Commercial copying, duplication or reproduction is prohibited.