I cannot begin to count the number of people who I have talked to over the years that say, “I wish I had started saving for my future earlier” or, “I always figured I’d get around to it.” As we progress through life, there are always going to be more ways to spend your money. If you don’t give some of it back to yourself, you’ll wake up when you’re fifty and realize that you’ve got fifteen or twenty years left to work, and you don’t have a single dime set aside.

Looking at your future and setting goals for things like educating your children, upgrading your home, or retiring, is hard work and most people don’t naturally go out of their way to find hard work to do.

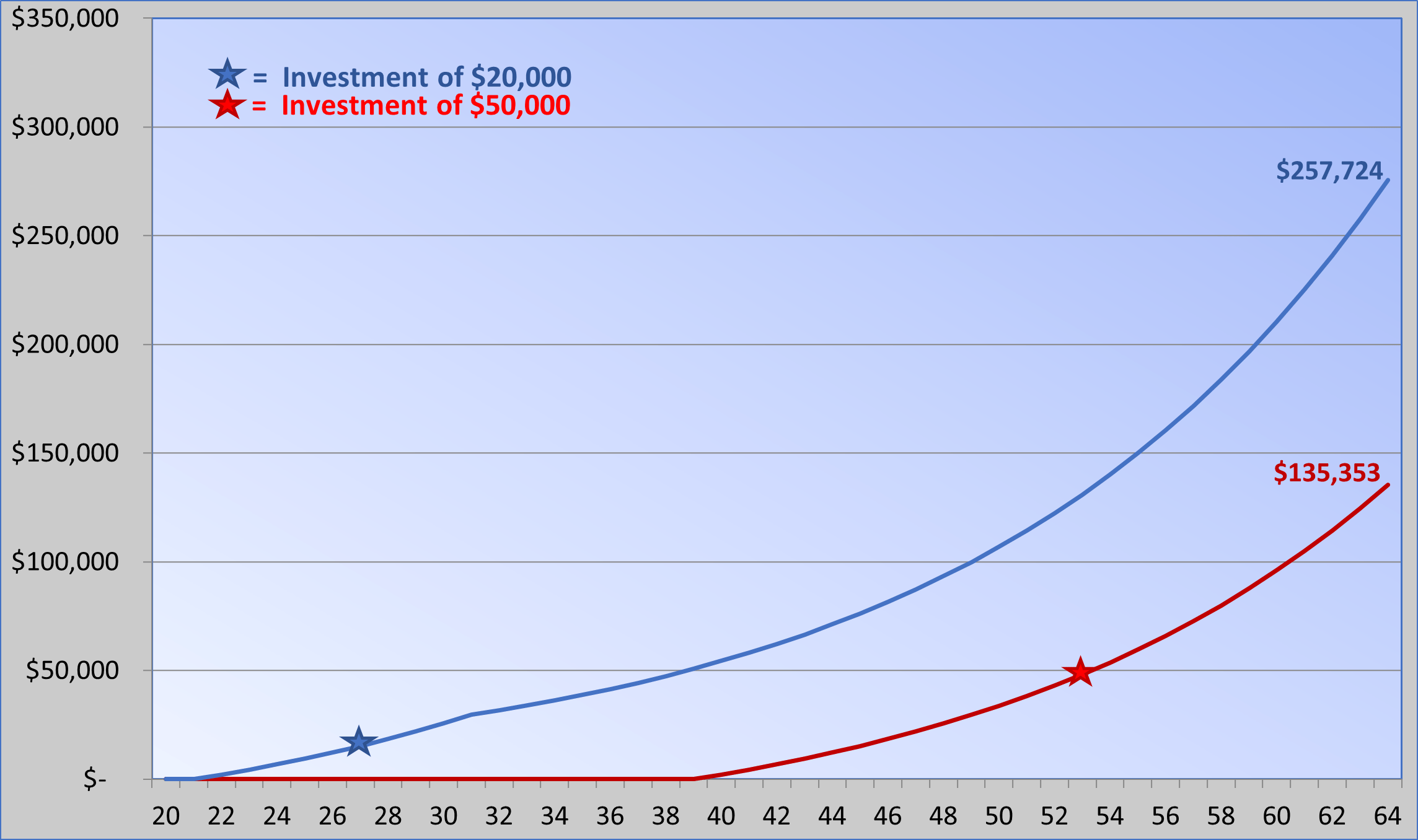

To put this dilemma into perspective, here is a hypothetical example: Let’s say you are twenty-two years old, and you have your first ‘adult’ job. You start to put away $2,000 per year and continue contributing this same amount into a retirement account for ten years. At this point, you would have contributed $20,000 of your own money. If you never put away another cent, and you get an average annual return on your money of 7%, then when you are sixty-five you would have approximately $275,724 – and remember, only $20,000 of that balance is what you personally put in.

On the other hand, let’s say you were to wait until you were forty to start putting money toward retirement. You start to put away $2,000 per year and continue contributing this same amount into a retirement account until you are sixty-five. At this point, you would have contributed $50,000 of your own money, over the span of twenty-five years. If you get an average annual return on your money of 7%, then when you are sixty-five you would have approximately $135,353 – and remember, you have contributed $50,000 of that balance.

That’s right – you are looking at an ending balance difference of $140,371. See chart

If you are reading this and thinking, “Well, how much would the forty-year-old have to contribute each year to have the same ending balance at age sixty-five?” The answer is a little over $4,000 per year, totaling $101,575. Quite a bit more than the early saver had to put in.

Moral of the story: Procrastination doesn’t pay.

These are the opinions of Legacy Wealth Management, LLC and not necessarily those of Cambridge, are for informational purposes only, and should not be construed or acted upon as individualized investment advice.

Mike Berry is a Registered Representative offering securities through Cambridge Investment Research, Inc., a Broker/Dealer, Member FINRA/SIPC. Investment Advisor Representative, Cambridge Investment Research Advisors, Inc., a Registered Investment Advisor. Legacy Wealth Management, LLC and Cambridge are not affiliated. Cambridge does not offer tax advice.

Copyright ©2022 Mike Berry. All Rights reserved. Commercial copying, duplication or reproduction is prohibited.